L’avenir de votre enfant commence aujourd’hui

Nous sommes là pour vous aider à les aider

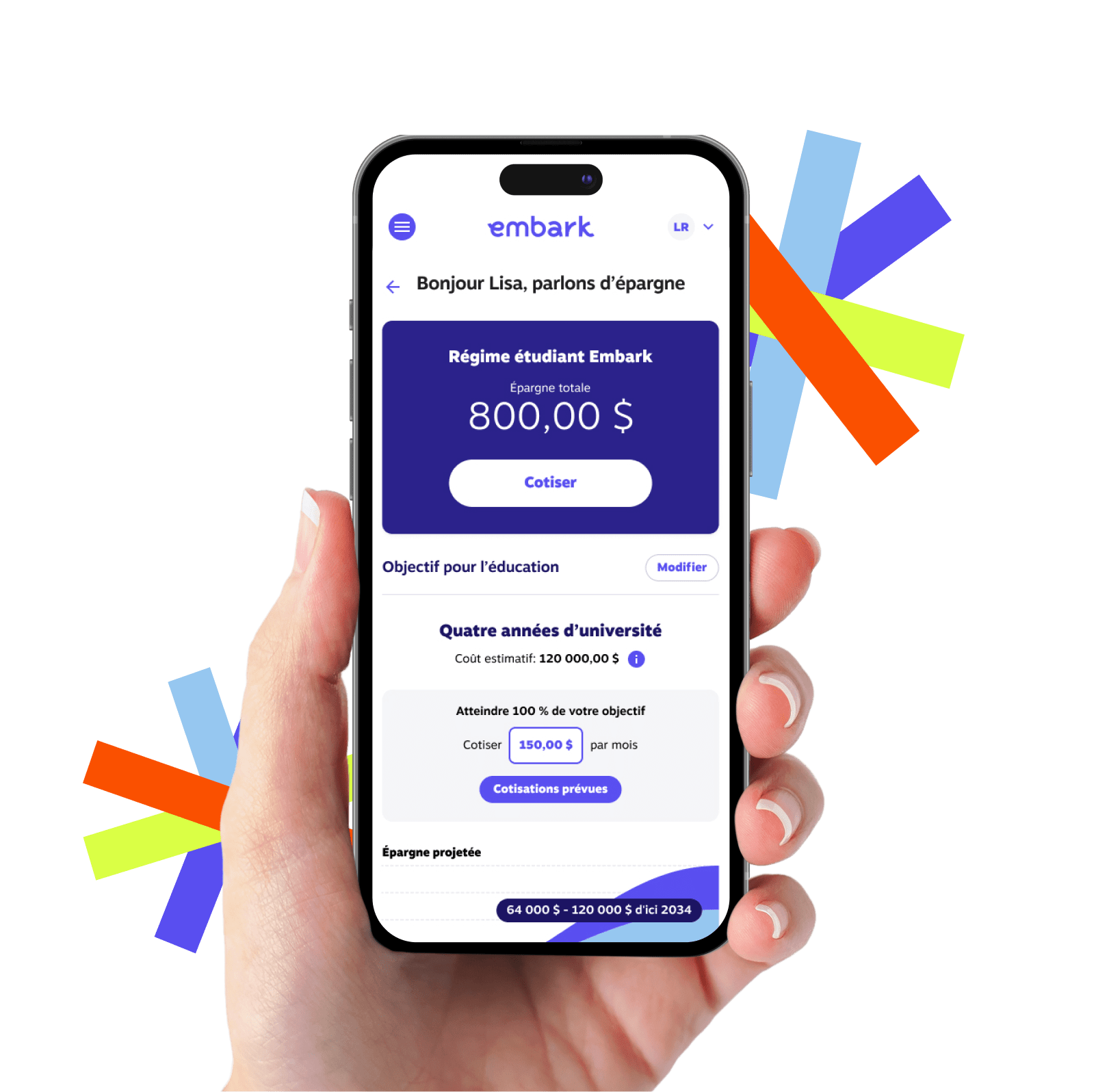

Chez Embark, notre seule activité, c’est l’épargne et la planification pour les études. Notre unique objectif est d’aider les étudiants à réaliser leur plein potentiel en simplifiant votre épargne à l’aide d’outils, de conseils et d’un régime d’épargne-études qui convient à votre famille.

Épargner pour l’avenir n’a jamais été aussi simple

- Un régime d’épargne qui s’ajuste automatiquement au fil du temps

- Des conseils d’expert clairs qui simplifient vos investissements

- Une plateforme numérique innovante qui met l’épargne-études à votre portée

- La capacité de partager votre régime entre plusieurs enfants

Simplifier les REEE

Créons votre avenir

Vous et votre enfant avancez ensemble. Chaque pas vous rapproche de l’avenir que vous lui souhaitez, un avenir où il sera épanoui. Le Régime étudiant Embark est là pour répondre à vos besoins afin d’aider votre enfant à réaliser ses rêves. C’est l’un des gestes les plus importants que vous accomplirez pour préparer l’avenir de votre enfant.

Plus de 60 000

étudiants utilisent le Régime étudiant Embark pour régler leurs frais d’études postsecondaires chaque année.

Plus de 1,2 million

de familles et de bienfaiteurs bénéficient des avantages du Embark.

Plus de 50 ans

d’expérience en épargne-études et en planification pour aider votre enfant à s’épanouir.

Guider vos pas vers la réussite des études

Embark appartient à un organisme sans but lucratif. Cela signifie que tous les profits qui ne sont pas utilisés pour gérer l’entreprise sont reversés à la Fondation Embark étudiant. Nous utilisons ces fonds pour offrir des bourses additionnelles afin d’aider les étudiants à réaliser leur plein potentiel. Nous avons accordé près de 57 millions de dollars aux familles et aux étudiants de tout le pays pour les aider à épargner en vue de leurs études.

Faciles d’accès, et en plus, ils s’occupent de tout pour vous.

Lola O.